Life is full of surprises, and keeping your family safe is key. Term life insurance is a smart choice. It gives you coverage for a set time, making sure your loved ones are okay if you’re not around. It pays out a death benefit to your chosen beneficiaries, helping them cover bills like the mortgage, childcare, and more.

Learning about term life insurance helps you protect your family’s future. This article will cover the basics of term life insurance. You’ll learn about getting quotes, understanding policy terms, and more. It’s all here to help you make a choice that’s right for your family.

Understanding Term Life Insurance

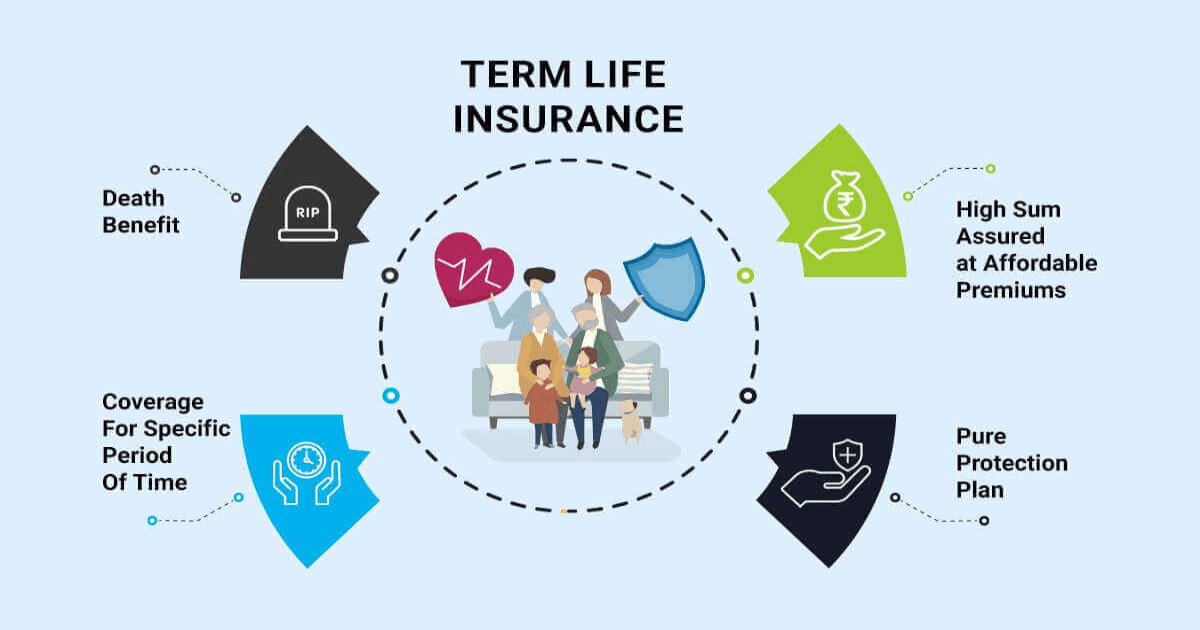

Term life insurance is simple and affordable. It’s different from permanent life insurance because it only lasts for a set time. You pay a fixed premium each month. If you die during this time, your loved ones get a big death benefit.

What is Term Life Insurance?

Term life insurance is a life insurance policy that lasts from 1 to 30 years. The cost stays the same, making it easy to budget. This makes it a great choice for many people.

How Does Term Life Insurance Work?

When you buy term life insurance, you pick how long you want coverage. If you die during this time, your family gets the death benefit. But if you live longer, the coverage ends. You’ll need to get a new policy to keep your family protected.

| Key Features of Term Life Insurance | Explanation |

|---|---|

| Coverage Period | The time your policy is active, usually 1 to 30 years. |

| Death Benefit | The money your family gets if you die during the coverage period. |

| Premium Payments | The monthly payments you make to keep your policy active. These costs don’t change. |

| Beneficiaries | The people or groups you choose to receive the death benefit if you pass away. |

Term life insurance is a simple and budget-friendly way to protect your family. Knowing how it works helps you choose the right policy for your needs and budget.

Term Life Insurance: Affordable Coverage for a Specific Period

Term life insurance is known for being affordable. It’s a favorite among people and families looking for life insurance. Compared to other options, term life policies have lower premiums. This makes it easier to budget for life insurance.

The main benefit of term life insurance is the coverage period. You can choose a term like 10, 20, or 30 years. The premiums stay the same during this time. This lets you plan your insurance based on your needs and budget.

Term life insurance is affordable because it has a limited coverage period. It doesn’t offer lifelong protection like whole or universal life insurance. But, it’s cheaper because it only covers you for a set time. This makes it a more affordable choice for many.

“Term life insurance offers a cost-effective way to protect your loved ones, with the flexibility to adjust your coverage as your needs evolve over time.”

Term life insurance is great for many reasons. It’s good for starting a family, securing a mortgage, or planning your future. It provides the protection you need at a cost you can afford. Knowing its benefits helps you choose the right insurance for your goals.

Calculating Your Term Life Insurance Needs

Finding the right term life insurance coverage can be tricky. It depends on your personal and financial situation. You need to think about your income, debts, dependents, and future goals.

Factors to Consider

When figuring out your term life insurance needs, consider these factors:

- Your current income and what your family needs to keep living the same way if you’re gone

- Any debts, like a mortgage or car loans, that need to be paid off

- The number of dependents, like kids or aging parents, and how much they cost

- Your future goals, like paying for your kids’ education or your spouse’s retirement

Online Life Insurance Calculators

Many insurance companies have online calculators to help you figure out how much coverage you need. These tools consider your income, debts, dependents, and goals. They give you a personalized amount based on your situation.

| Key Factors | Considerations |

|---|---|

| Income Replacement | The amount needed to replace your income and maintain your family’s standard of living |

| Debt Repayment | Any outstanding debts, such as a mortgage or loans, that need to be paid off |

| Dependent Needs | The cost of providing for your dependents, including children and aging parents |

| Future Financial Goals | Funding your children’s education or ensuring your spouse’s retirement |

By looking at these factors and using online calculators, you can find the right term life insurance. This ensures your loved ones are financially secure, giving you peace of mind.

The Underwriting Process for Term Life Insurance

Getting a term life insurance policy starts with the underwriting process. The insurance company checks your risk level. They look at your age, health, lifestyle, and medical history. This helps them set the right premium for you.

The underwriting process has a few key steps:

- Application review: The insurance company checks your application carefully. They look at your personal info, medical history, and any health issues.

- Medical exam: You might need a medical check-up. A doctor will gather info about your health and well-being.

- Risk assessment: The company will look at your risk factors. This includes your age, gender, job, and lifestyle. They want to know if you might make a claim in the future.

- Policy approval: After assessing your risk, the company decides if they’ll approve your application. They’ll also set the premium for your term life insurance policy.

Knowing about the underwriting process helps you prepare. It makes the application smoother and gets you better terms for your term life insurance. Being open about your health and personal info ensures a fair assessment. This leads to a policy that fits your needs and budget.

| Underwriting Factor | Impact on Term Life Insurance Premium |

|---|---|

| Age | Older applicants typically pay higher premiums due to increased risk. |

| Health Status | Applicants with pre-existing medical conditions or poor health may face higher premiums or even policy exclusions. |

| Lifestyle Habits | Risky behaviors, such as smoking or dangerous hobbies, can result in higher term life insurance rates. |

| Occupation | Individuals with hazardous occupations may pay more for term life insurance coverage. |

Understanding the underwriting process and its effect on term life insurance premiums helps you make smart choices. It ensures you get the coverage you need to protect your loved ones.

Choosing the Right Term Life Insurance Policy

When picking a term life insurance policy, there are key things to think about. The coverage period, the death benefit amount, and the premium payments are all important. They help you find the best insurance policy to protect your loved ones.

The coverage period, or “term,” can last from 10 to 30 years. This lets you pick a term that matches your needs and budget. The death benefit, the money given to your loved ones when you pass away, can be adjusted to fit your financial situation. This ensures your family is taken care of.

To get the best deal, it’s smart to compare term life insurance quotes from different companies. This way, you can find a policy that offers enough financial protection for your loved ones. It should also fit your budget for premium payments.

| Coverage Period | Death Benefit | Annual Premium |

|---|---|---|

| 10 years | $250,000 | $200 |

| 20 years | $500,000 | $400 |

| 30 years | $1,000,000 | $800 |

By thinking about these factors carefully, you can find the term life insurance policy that offers the right mix of coverage and cost. This ensures your loved ones are safe if you pass away.

Conclusion

Term life insurance is a simple and affordable way to protect your family’s future. It offers a clear coverage period and a death benefit. This helps you make a smart choice to keep your loved ones safe if you pass away.

Looking for life insurance quotes? Want a specific coverage period? Term life insurance has many options. It gives you peace of mind and financial security for your family. Its low cost and flexible terms make it a great investment.

Think about what your family needs and look at different term life insurance policies. You can find the perfect one to keep your family financially stable, even when unexpected things happen. Take your time to review your choices and pick the one that fits your family’s needs and goals.

FAQ

What is Term Life Insurance?

Term life insurance offers coverage for a set time, known as the “term.” You pay a fixed premium during this time. If you pass away, your loved ones get a lump sum from the insurance company.

How Does Term Life Insurance Work?

It’s a way to protect your family’s finances if you’re not around. You pay a fixed premium for a set period. This makes it easy and affordable to get life insurance.

What are the Benefits of Term Life Insurance?

It’s very affordable compared to other life insurance. You can get it for a fixed period, like 10 or 20 years. This lets you budget for your life insurance needs.

How Do I Determine the Right Amount of Term Life Insurance Coverage?

Figuring out how much coverage you need can be tricky. Think about your income, debts, dependents, and future goals. Many websites have calculators to help you figure it out.

What is the Underwriting Process for Term Life Insurance?

The underwriting process is key to getting a policy. The insurance company looks at your age, health, and lifestyle. They might ask for a medical exam to assess your risk.

What Should I Consider When Choosing a Term Life Insurance Policy?

Look at the coverage period, death benefit, and premiums. Choose a term that fits your needs, and a death benefit that’s right for your family. Also, compare prices from different companies to find the best deal.